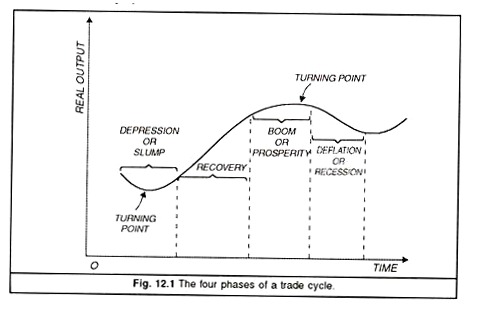

The following points highlight the four main phases of a trade/business cycle. The phases are: 1. Slump 2. Recovery 3. Boom 4. Deflation.

Business Cycle Phase # 1. Slump or Depression:

This is the most critical and fearful stage of a trade cycle. Harberler has described depression as “a state of affairs in which real income consumed or volume of production per head and the rate of employment are falling and are sub-normal in the sense that there are idle resources and unused capacity, especially unused labour.”

A slump or depression shows itself first in a substantial decline in general output and employment.

The decline in economic activity is not, of course, uniform. Contraction in output might be much more in manufacturing such as machinery and equipment, mining, construction and transport than in retail trade or agriculture.

ADVERTISEMENTS:

While output and employment tend to fall fast during the slump, prices and wages continue to decline. This is really agonizing experience for both the producers and the workers. Prices decline because of the expectations of producers in general that these would continue to fall in spite of all governmental efforts.

While the producers try to dispose of their stocks at the current market prices, the consumers tend to postpone their purchases in the hope that the prices would fall further and they would be able to benefit from it.

Scared by the general slump in the economy, the financial institutions press the producing firms to return their advances according to the contract. This forces the producers to meet their contractual obligations through unintended sales of their inventories in a market where prices are already declining.

This deepens the depression further. Most firms reduce their output and as such are forced to lay-off workers. As unemployment increases, the wages tend to fall under its pressure.

However, the fall in wages is less than the fall in prices. This is because workers’ unions strongly oppose wage reductions. The rate of fall in prices of agricultural raw materials is generally more than chat of manufactured goods.

This is because the producers are not prepared to lift off the supplies of the raw materials which causes a sharper fall in their prices than the prices of manufactures. The wholesale prices fall faster than the retail prices. These sudden changes in the relative price structure of the economy cause dislocations in production and exchange.

Depression or slump leads to redistribution of the national income. Profits and wages fall faster relatively to rent and other fixed incomes. Incomes of shareholders go down fast. This reduces the deposits with banks and other financial institutions.

They, in turn, follow the policy of credit contraction. While producers are reluctant to borrow because of dull trade conditions, the financial institutions are hesitant in lending for fresh investments. This causes the depression to persist for a longer period than it would have lasted on its own.

Business Cycle Phase # 2. Recovery:

ADVERTISEMENTS:

Recovery shows the upturn of the output and employment of the economy from the state of depression. Recovery is most probably the result of the fresh demand for plant and equipment arising from the consumer goods industries which had been postponing this investment during depression.

The capital goods have a limited life. They wear out completely after some time and need replacement. This replacement demand starts the recovery process.

Although prices remain more or less stable, wages and other incomes show a noticeable rise. Profits and hence dividends start rising which spurs the producers to float fresh investment proposals in the stock market. Since incomes rise, consumer spending also rises to encourage increased production. Soon the other business activity also picks up.

The appearance of new demand for capital goods, existence of low interest rates, willingness of financial institutions to extend credit and optimistic expectations of the investors about the future, all generate a favourable climate for new investment. The stock exchanges bear out the signs of recovery in the form of rising dividends and bullish share markets.

It must be pointed out here that a non-intervention policy from the government fails to start the recovery phase. Recover)’ is a slow and halting process. The government has to pursue stabilisation policies and show special initiatives in dispelling the pessimistic mood of the investors. The economic system, left to itself is likely to stagnate in the state of depression for an intolerably long period for the working class.

Business Cycle Phase # 3. Boom or Prosperity:

During the recovery phase, rise in output and incomes of the people induces substantial increase in aggregate spending. This has a multiplier effect. As effective demand increases, income rises faster than before. The whole process becomes self-reinforcing.

The cumulative process of rising investment and employment forges ahead. As investors become more confident, expanding productive activity takes the economy to a boom or prosperity phase.

According to Haberler, prosperity is “a state of affairs in which the real income consumed, real income produced and the level of employment are high or rising, and there are no idle resources or unemployed workers or very few of cither”. This means that the ideals of full employment of the labour force and full utilisation of productive capacity are realized in the prosperity phase. There is a state of exuberance and enthusiasm in the business community.

Industrial and commercial activity, both speculative and non-speculative, shows remarkable expansion. Construction activity gets a big boost. Share markets reflect the general state of exuberation of the investors. Share markets give handsome gains to investors which encourages accumulation of inventories of durable capital goods.

ADVERTISEMENTS:

Financial institutions tend to expand credit as the interest rates and discount rates go up. Thus, everyone seems to be happy during the state of prosperity which ultimately, of course, proves to be short-lived.

Business Cycle Phase # 4. Recession:

The end to prosperity phase comes because of certain tendencies in the private-enterprise economy prevalent during the boom conditions.

Firstly, as prices rise, wages tend to lag behind. As a result, purchasing power of workers, who form a majority of the people, tends to lag behind the supply of consumer goods.

Secondly, expansion of production is hampered by shortages of some inputs and bottlenecks in production.

ADVERTISEMENTS:

Thirdly, excessive demand for labour and materials pushes up both the factor and the product prices but in a disproportionate fashion.

Fourthly, the non-availability of credit beyond a particular rate of expansion might also act as a serious break on prosperity. Financial institutions including banks cannot expand credit beyond a limit put by their reserve requirements. As this limit is reached, they start recovering their loans. Shortages of finance crop up.

Firms are forced to liquidate their stocks when most firms try to sell their output at the same time, the price level starts falling. When some firms get involved in losses in this way a wave of pessimism runs through the share markets.

Production schedules by firms are curtailed, workers are laid off and outstanding orders for raw materials are cancelled. In this way the wave of pessimism gets transmitted to other sectors of the economy. The whole economic system thereby runs into a crisis. Thus the next stage of the trade cycle, called recession of deflation starts.

ADVERTISEMENTS:

When sure signs of recession appear on the stock and financial markets, over- pessimism, nervousness and fear born out of uncertainty overtake the businessmen. In this atmosphere, new projects are shelved. Even the projects in hand may be abandoned. Some firms go sick. Others simply go bankrupt. All this hastens the process of economic contraction.

The fall in the purchasing power of the general public reduces demand for consumer goods which aggravates the slackening demand for machines and equipment. Construction activity falls significantly. The business world goes panicky.

In this way, as M. W. Lee has remarked, “a recession, once started, tends to build upon itself much as forest fire. Once underway, it tends to create its own drafts and give internal impetus to its destructive ability”. What was recession or deflation for some time now converts itself into depression.