In this article we will discuss about the Use of Computers in Economic Analysis and Forecasting.

Introduction to Computer:

Computers are now-a-days often used in making complicated investment decisions. As we add more branches to the decision tree, we reduce our ability to analyse problems quickly. However, the rapid development of sophisticated computer equipment has increased the usefulness of computer-based analysis of complex investment decisions.

For example, the decision to build a nuclear power plant is a difficult one. It can take up to ten years to complete such a project. Along the way there may be threats of strikes, unanticipated cost increases, technical problems, and resistance from antinuclear groups. Revenues depend on future demand. Demand depends on production trends, income levels, energy use, and alternative sources of energy.

If we can determine probability distributions for each of these factors, we can programme a computer to simulate the future. The computer randomly selects a value from each of these distributions and simulates its effect on the firm’s demand and cost functions. After hundreds of these simulations, the computer generates a distribution on the expected rates of return from this decision.

ADVERTISEMENTS:

If there is a choice of projects, the firm can use the simulated rates of return to calculate both the expected return and the degree of risk involved. Using the certainty equivalent method or the risk-adjusted discount rate, the firm can compare these investments. However, the success of this approach depends on the quality of the probability distributions of a large number of variables.

By using a similar but less-involved method, the firm can arbitrarily choose a best-guess value for each of the variables of importance.

For example, by recalculating the expected rate of return by varying each of these variables within a reasonable range, the firm can determine the sensitivity of the expected rates of return to changes in these variables. The firm can then concentrate on finding more precise estimates of those variables that have the greatest influence on the expected rate of return of the project.

Using sophisticated in-house technology a major computer manufacturer developed a United States-based rein voicing center that controls literally all of the company’s cross-border transactions.

ADVERTISEMENTS:

The computer system provides daily worldwide exposure reports, facilitating centralized exposure management, aggressive leading and lagging strategies and substantial savings on holding costs each year— an impossible chore without a computer.

1. Computers Streamline Operations:

In today’s highly competitive business world, firms strive to increase productivity and slash costs. In fact, a growing number of companies are instituting austerity programmes to cut layers of corporate management, especially on the international side.

Computers play a critical role in this effort. By automating finance, companies can reduce labour costs and dramatically improve the speed and accuracy of many routine tasks.

ADVERTISEMENTS:

For example, the controller of a leading American automobile manufacturer believes that computers are essential for producing a cost-competitive car. By using computers it is possible to reduce labour costs considerably and produce less expensive cars.

2. Computers help Companies Manage Globalized Businesses:

As part of their drive to be competitive many companies now turn each of their component businesses as world-wide organisations, and plan their manufacturing and sourcing strategies on a global basis. To manage their far-flung operations effectively, firms increasingly turn to computers.

As one financial executive of a large multinational noted, “We receive data from over 50 markets. Without computers we couldn’t possibly coordinate that volume of data quickly and efficiently.”

One main reason for the use of computers in economic analysis and forecasting is the widespread availability of in expense, convenient microcomputers. The personal computer (PC) has already become a fixture in financial departments the world over.

People are drawn by what PCs have to offer. For a small investment of time and effort one can now, perform various financial analyses more easily and quickly. The end result is increased productivity.

The capital budgeting process encompasses a variety of planning activities with a time horizon of more than one year, which is an increasingly difficult and critical exercise in today’s environment. Extremely volatile currency and interest rates, political upheavals, and the sudden imposition of exchange controls all pose threats to what once were secure overseas investments.

Now numerous fast- growing companies are turning to automation to cope with these uncertainties. As one financial planning manager explained, “The biggest risks about projects now-a-days are the assumptions. By using computers, you can determine which of the assumptions are the most sensitive. This produces more and better data to use and rely on.”

It appears that over the next few years, global firms will more than double their use of computers for such key capital budgeting functions as project investment analysis and long-term portfolio planning, and will increasingly automate the forecasting of financial trends and political risk analysis to buttress their decisions.

ADVERTISEMENTS:

Project investment analysis encompasses all DCF forecasting methods such as NPV, IRR, and payback period. Once a project has been proposed, finance staff must conduct sensitivity analysis. For example, what happens to the IRR on a project should prices degrade rather than hold constant? Other variables include price, market share, market volume, general economic conditions, and political risk.

According to a recent survey, the use of computers for analysing capital project proposals will rise dramatically over the next few years. This tremendous surge can be attributed in part to the spread of the PCs to all aspects of financial planning.

The use of PCs has enabled senior management to standardize new project analysis corporate-wide. The analysis process works as follows: Twice a year, the corporate planning department evaluates current costs of capital and, based on those figures, determines an appropriate hurdle rate for new projects.

In the past corporate economics department was seen as an aloof and separate entity. Now, through better integration of the economics department with the finance function, the corporate economic staff has become a more relevant factor in capital budgeting analysis.

ADVERTISEMENTS:

They are involved in capital budgeting in two primary ways:

1. They prepare a summarized list of standardized economic assumptions, which are distributed corporate-wide. The economics department now concentrates on those parts of the economy perceived as most critical in the long run, such as real growth of the economy, interest rates and inflation. To distribute the forecast data, staff relies both on in-house publication and computer networks.

2. They respond to ad hoc queries from local project analysts. The use of computers has made it easier for corporate economists to get involved in the analysis for new project proposals. For example, if a review is under way to evaluate committing funds for a major plant expansion in a certain country or region, an economist may be required to estimate long-term project demand, inflation rates, or currency fluctuations.

Forecasting:

In the present age of uncertainty and information revolution managerial focus has shifted to improving the decision-making process in business and government. The key point in decision-making is accurate forecasts. In the area of marketing, for instance, forecasts of market size and market characteristics must be reliable.

ADVERTISEMENTS:

A company producing and selling refrigerators, T.Vs., etc., must make accurate forecasts of both regional market demand and types of customers. Based on this forecast, decisions regarding advertising and other sales promotion efforts are taken.

In the area of production management also there is need for forecasting. Product demand and product mix, production scheduling, inventory holding, labour scheduling, equipment purchase, plant capacity planning, maintenance, etc., are all based on such forecasts.

In finance and accounting, forecasting is of strategic importance in the area of cash flows, debt collection, capital expenditure rates, working capital management etc. Even the personnel department is required to make manpower planning which is nothing other than forecast for different types of human resources required in business now and in the future.

Approaches to Forecasting:

ADVERTISEMENTS:

Prior to 1950s there existed hardly any method for business forecasting. In the mid-1950s exponential smoothing technique was first used by the defence personnel for forecasting purposes. Subsequently, this technique was applied to business organisations.

In the 1960s the computer power became cheaper and techniques like multiple regression and econometric models were widely used to quantify and test economic theory with statistical data. As economics entered the age of computers in the 1970’s the process was hastened by the availability of cheap computers.

In 1976 the Box-Jenkins method was developed. It is a systematic procedure for analysing time series data. In truth, the Box-Jenkins approach to time-series forecasting was as accurate as the econometric models and methods.

In the 1960s and 1970s technological forecasting methods were developed of which the Delphi method and cross-impact matrices were very popular. However, in 1970s it was first realised that forecasts were useless unless they were applied for planning and decision-making purposes.

Matching the Situations with Forecasting Methods:

There are various methods of forecasting. Different methods are suitable for different situations and different purposes. A manager must select the appropriate forecasting technique, i.e., the one which answers his needs (or serves a particular purpose).

ADVERTISEMENTS:

Six important characteristics or dimensions of planning and decision-making which determine the choice of forecasting methods are the following:

1. Time Horizon:

The period of time for which the decision is made will have an impact. It may be the immediate term (i.e., less than one month), short-term (up to 3 months), medium-term (up to-2 years) long-term (more than 2 years).

2. Level of Details:

While selecting a forecasting method for a particular situation, one must know the level of details which will be needed for the forecast to be useful for decision-making purposes. The need for detailed information varies from situation to situation and time to time.

ADVERTISEMENTS:

3. The Number of Variables:

The number of variables to be forecast affects the need for detail which, its turn, determines the choice of appropriate methods even in the same situation. When forecast is to be made for a single variable, the procedures used can be more detailed and complex than when forecasts are made for a number of variables.

4. Constancy:

Forecasting a situation which does not change is different from forecasting a situation which is fairly unstable (i.e., a situation which often keeps on changing).

ADVERTISEMENTS:

5. Control Vs. Planning:

The controlling function is performed by using a new technique called management by exception. Any forecasting method must be sufficiently flexible so that the changes in the basic patterns of behaviour of variables or relationships among them can be detected at an early stage.

6. Existing Planning Procedures:

For introducing new forecasting methods, often the existing planning and decision-making procedures have to be changed. Moreover, in case of any deviation from a set path it gives early warning and the managers face human resistance to such changes.

So the usual practice is to select those forecasting methods which are most closely related to the existing plans and procedures. In case of necessity, these methods can be improved later on.

Six major factors which are considered important in forecasting are given below:

(1) Time Horizon:

Two aspects of the time horizon are related to most forecasting methods, viz., the span of time in future for which different methods are appropriate and that the number periods for which a forecast is required.

(2) Data Pattern:

For matching forecasting methods with the existing pattern of data (i.e., seasonal/cyclical, time-series/cross section etc.) an appropriate method is to be selected.

(3) Accuracy:

Forecasts must be as accurate as possible.

(4) Cost:

In any forecasting procedure the following costs are generally involved:

(a) Development;

(b) Data preparation;

(c) Actual operation; and

(d) Cost of foregone opportunity.

(5) Reliability:

Managers should not forecast anything based on data which is not reliable for the purpose of managerial decision making.

(6) Availability of computer software:

It is not possible to apply any given quantitative forecasting method without an appropriate computer programme. Programmes must be “free” from major “bugs”, well documented and easy to use, for getting satisfactory results.

Forecasting Tools:

Economists have developed various forecasting tools to be able to foresee changes in the economy. In earlier times, economists used to look into the future by using easily available data on things like money supply, house construction, and steel production. For example, a sudden fall in steel production was a sign that businesses had reduced purchases and that the economy would soon slow down.

At a later stage this process was formalized by combining several different statistics into an ‘index of leading indicators’, which is now published every month by the US Department of Commerce. Although not very accurate, the index gives an early and mechanical warning on whether the economy is heading up or sliding down.

For a more accurate prediction of some key variables and for a more detailed look into the future, economists turn to computerised econometric forecasting models. Due to the pioneering works of Jan Tinbergen and L. R. Klein macroeconomic forecasting has gained much popularity and considerable reliability over the last 25 years.

The Wharton Forecasting Model developed in the Wharton Business School, Pennsylvania, is perhaps the most elaborated of all. Private consulting firms, such as Data Resources Inc., have developed models that are widely used by businesses and policy makers.

Computers and Forecasting:

The commercial computers in the 1950s were very large, complicated, slow and expensive. Moreover, they had minimum storage capacity. In the 1960s substantial improvement on it was made.

The powerful microcomputers of today run faster, are comparatively cheap and contain more RAM memory. It is likely that there will be further improvement in speed memory and capacity of computers. It also seems that cost and size of the computers will also be reduced in the future.

Two major advantages of modern computers are the incredibly high speed and great accuracy with which they can do calculations. Hence any forecasting method can be programmed to run on a computer. Even the most calculation-intensive methods can be run on a micro-computer within a few minutes.

How are computer models of the economy constructed and used for forecasting purposes? As a general rule forecasters start with an analytical framework containing equations representing both aggregate demand and aggregate supply.

Using modern econometric techniques, each equation is ‘fitted’ to the historical data to obtain parameter estimates (such as the M PC, the shapes of the money- demand equations, the growth of potential GNP, etc.). Additionally, at each stage of the forecasting exercise modellers use their own judgement and experience to assess whether the results are reasonable.

Finally, the whole model is put together and run as a system of equations. In small models there are one or two dozen equations. Today, large systems forecast from a few hundred to 10,000 variables.

After specifying the exogenous and policy variables (such as population, government spending and tax rates, monetary policy, etc.), the system of simultaneous equations can project important economic variables into the future.

A Case Example:

We may now explain and illustrate how a quantitative method can be programmed and run on a computer.

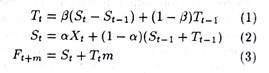

In this context are may refer to Robert Holt’s linear exponential smoothing forecasting method which uses the following three equations:

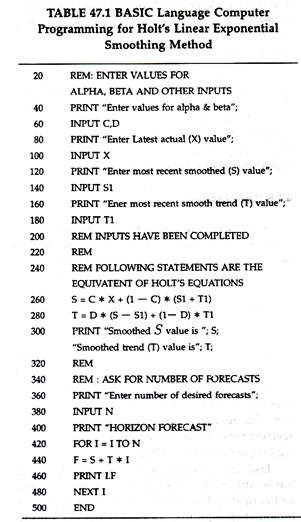

Selecting BASIC as the computer programming language, the above equations can be programmed as follows:

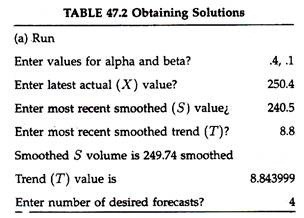

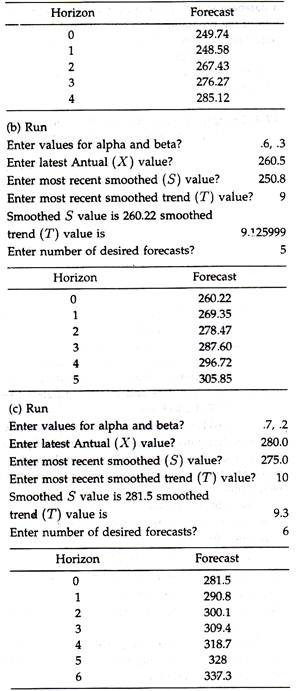

Assuming the values of X as 250.4, 260.5 and 280.0 respectively; S as 240.5, 250.8 and 275.0 respectively; T as 8.8; 9.0 and 10.0 respectively; a and (3 as .4 and .1; .6 and .3; and .7 and .2 respectively, we get the following results:

The programming given in Table 47.1 is not very useful for management purposes. Here the user must provide the input values of α and β, which can be avoided since the computer can be programmed to find the optimal values of α and β. Again, the computer can be programmed to initialize St-1 and Tt-1 at the beginning and stored in the memory, but here the user is to provide input St–1 and Tt–1

Moreover, the latest Xt value can be retrieved from a database stored in the memory. Hence modification of the programme can only make it automatic, requiring the minimum amount of inputs from the users. The modified programming will be able to forecast automatically thousands of items as and when required.

Computer Systems for Handling Multiple Quantitative Forecasting Methods:

A single forecasting method may not be suitable for all purposes and appropriate for all situations. Hence it is better to have separate computer programme for different methods, similar to Holt’s method. In addition, there must be an overall control programme with a “menu” of alternative methods, to cheek the results of various methods and take corrective actions.

Various such computer-based forecasting systems have been developed of which SIBYL is most useful and is widely used in universities and business organisations. New versions and batch versions are available which can be run on most large (main frame) computers, major time-sharing networks, mini computers and micro computers like IBM and APPLE machines.

The SIBYL-forecasting system is a philosophy for methodical forecasting and a computerised package of programme. These deal with simple applications at first and go into difficult problems thereafter. Hence this is very useful for tutorial purposes.

The SIBYL system provides software programme for dealing with the following four essential forecasting functions:

(1) Data preparation and handling of data.

(2) Screening of existing forecasting methods.

(3) Application of the methods chosen.

(4) Comparison, selection and combination of forecasts.

Item (1) deals with preparation of data files; data entry, data updating, transformation of data programmes and graphing.

Item (2) deals with selection of an appropriate forecasting technique for a particular purpose. This is done in the SIBYL programme. The user is given a list of methods which are suitable for a given situation and a summary of the characteristics of the given situation.

Item (3) deals with the application of the method chosen to the specific forecasting situation;

The SIBYL package has 24 computerised subroutines of the most commonly used univariate and multivariate time-series and multiple regression techniques.

Item (4) deals with preparing and combining results obtained from alternative forecasting methods. Individual techniques are applied to a given situation and the results are automatically stored in the memory and recalled at the end of the programme. Thus it helps us to locate the best method for obtaining the most satisfactory results.

Conclusion:

Today we all recognise the transformation that computers have wrought in the workplace and in our lives. In just the 14 years since the personal computer brought new power to our desktops and workbenches, the changes have been stunning.

A close look at corporate management simply reveals that with information now moving from the factory floor throughout the company at blinding speed, whole layers of corporate management have been rendered obsolete.

And companies have now learned that the speed of today’s more competitive environment does not leave time for dithering over decision, anyway. The resulting learner style has thinned management ranks while encouraging initiative and giving people more responsibility.

Like any powerful technology, the computer leaves little room for sentiment. It has spawned an Information Revolution that promises even more profound changes that we have witnessed already. There can be no doubt that these changes, like those of the Industrial Revolution, will, on balance, provide great benefits.

The digital tide has already reshaped the business world. Now it’s spilling out of the office to touch every aspect of our lives. Today’s software lets computers simulate workings of machines that don’t exist yet. The traditional self-contained computer is merging into the collective identity of the network.

However, predicting the computer’s effects seems perilous. As the most symbolic of all tools, it can be just about anything we programme it to be—a telephone switch, calculator, missile guidance system, or fantasy environment. That malleability is what stirs the imagination so strongly.

But one would do well to keep in mind what computer scientist Joseph Weizenbaum wrote 19 years ago in his book Computer Power and Human Reason: “We must learn the limitations of our tools as well their power. Even in its most advanced state, the computer is not, and never can be, a panacea for human problems or a substitute for our own, uniquely formed human judgement.”