According to Loan-able Funds Theory, also called the Neo-classical Theory, interest is the price paid for the use of loan-able funds.

Like the Classical and Keynesian theories of interest, it is also a demand and supply theory.

It asserts that rate of interest is determined by the equilibrium between demand for and supply of loan-able funds in the credit market.

There are several sources of both supply and demand of loan-able funds, which we discuss below:

Demand for Loan-able Funds:

The demand for loan-able funds comes mainly from the following four fields:

ADVERTISEMENTS:

(a) Business Investment or Firms.

(b) Consumers or households,

(c) Hoarding, and

ADVERTISEMENTS:

(d) Government.

(a) Business Firms:

The bulk of demand for loanable funds comes from business firms which borrow money for purchasing or making new capital goods, including the building up of inventories (i.e. stocks of goods). Demand for loanable funds for investment purposes by business firms is the most important constituent of total demand for loanable funds.

The price of the loanable funds required to purchase the capital goods is obviously the rate of interest. It will pay businessmen to demand loanable funds up to the point at which the expected net rate of return on the capital goods equals the rate of interest. Businessmen will find it profitable to purchase larger amounts of capital goods when the rate of interest (i.e. the price of the loanable funds) declines.

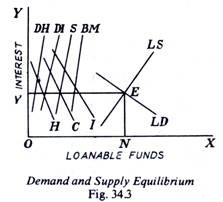

Thus, the demand for loanable funds for investment purpose is interest- elastic (i.e. changes with the rate of interest) and slopes downwards to the right. The demand for loanable funds for investment purposes is represented by curve I in Fig. 34.3.

(b) Consumers or Households:

The second big demand for loanable funds comes from individuals or households who want to borrow for consumption purposes. Individuals or households demand loanable funds when they wish to make purchases in excess of their current incomes and cash resources.

Generally, the loans for consumption are demanded for buying durable goods like automobiles, refrigerators, radios, television sets, etc. Lower rates of interest will encourage some increase in consumer borrowing. Demand for loanable funds for consumption purposes is shown by the curve ‘C’ (in Fig. 34.3), which is interest-elastic and slopes downwards to the right.

(c) Hoarding:

Thirdly, the demand for loanable funds may come from those who want to hoard money, i.e., to satisfy their liquidity preference. Hoarding signifies the people’s desire to hold their savings as idle cash balances. An important point to be noted here is that the one who supplies the loanable funds is the same person who demands the loanable funds for hoarding. A saver who hoards his savings can be said to be supplying loanable funds and also demanding them to satisfying his liquidity preference, i.e. demand for each.

Demand for hoarding is shown by curve H in the diagram (Fig. 34.3). The demand for hoarding money is interest-elastic and slopes downwards to the right. At higher rates of interest, people will hoard or hold less money, because much of the money will be lent to take advantage of the higher interest rates. Similarly, at lower rates of interest, people will hoard more money, because the loss incurred by hoarding in this case is not very much.

(d) Government:

The government is perhaps the biggest borrower, especially in developing countries. In planned development, government undertakes big industrial projects like steel plants, transport undertakings like shipping yards, huge multipurpose projects like the hydro-electric projects. The government also borrows for social welfare activities, and so on. Since the demand for loanable funds for all these purposes is inversely related to the rate of interest, the aggregate demand curve is therefore a downward sloping curve (see curve LD in Fig. 34.3).

Supply of Loanable Funds:

The supply of loanable funds is derived from the following four basic sources:

(a) Savings,

(b) Dishoarding,

(c) Bank Credit, and

ADVERTISEMENTS:

(d) Disinvestment.

(a) Savings:

Savings by individuals or households constitute the most important source of loanable funds. In the loanable funds theory, savings are looked at in either of these two ways: firstly, an ex-ante savings, i.e., savings planned by individuals at the beginning of a period in the hope of expected incomes and anticipated expenditure on consumption; or secondly, in the Robertson/an sense i.e. savings or the difference between the income of the preceding period (which becomes disposable in the present period) and the consumption of the present period. In either case, the amount saved varies at various rates of interest.

Savings by individuals and households primarily depend upon the size of their income. But given the level of income, savings vary at various rates of interest. More savings will be forthcoming at higher rates of interest, and vice versa.

Like individuals, businesses also save. A part of the earnings of a business concern is consumed as declared dividends and the undistributed or the retained part constitutes business or corporate savings. Such savings depend partly upon the current rate of interest.

ADVERTISEMENTS:

A high rate of interest is likely to encourage business savings as a substitute for borrowings from the loan market. But these business savings are often demanded for investment purposes by the firms themselves and, therefore, they do not enter the market for loanable funds.

(b) Dishoarding:

This is another source of loanable funds. Individuals may dishoard money from the hoarded stock of the previous periods. Thus, cash balances, idle in a previous period, become active balances in the present period and are available as loanable funds. At higher rates of interest, more will be dishoarded. At very low rates of interest, there is a greater tendency to hold on to money.

(c) Bank Created Money:

The banking system provides a third source of loanable funds. Banks by creating credit money can advance loans to the businessmen. Banks can also reduce the amount of money by contracting their lending. The new money created by the banks in a period adds greatly to the, supply of loanable funds. The supply curve of funds provided by banks is to some degree interest-elastic, i.e., it varies at various rates of interest. Generally speaking, the banks will lend more money at higher rates of interest than at lower ones, other things remaining the same.

(d) Disinvestment:

Disinvestment is the opposite of investment and takes place when, due to structural changes or bad ventures, the existing stock of machines and other equipment is allowed to wear out without being replaced or when the inventories are drawn below the level of the previous period.

ADVERTISEMENTS:

When this happens, a part of the revenue from the sale of the product, instead of going into capital replacement, flows into the market for loanable funds. “Disinvestment is encouraged somewhat by a high rate of interest on loanable funds. When the rate is high, some of the current capital may not produce a marginal revenue product to match this rate of interest. The firm may decide to let this to match this rate of interest. The firm may decide to let this capital run down and to put the depreciation funds in the loan market. “Thus, disinvestment adds to the supply of loanable funds. In Fig. 34.3, DI is the disinvestment curve and slopes upwards to the right.

By the lateral summation of the four curves, S (Savings), DH (Dishoarding). DI (Disinvestment), and M (Bank credit), we get the total supply curve of loanable funds (LS in Fig. 34.3) which slopes upwards to the right, showing that a greater amount of loanable funds will be available at higher rates of interest, and vice versa.