In this article we will discuss about the structure of fund flow statement.

The structure of fund flow statement like other accounting statements is based on the equality of financial assets and liabilities.

To bring the form of fund flow statement on a scientific line, the fund flow statement is divided into two parts:

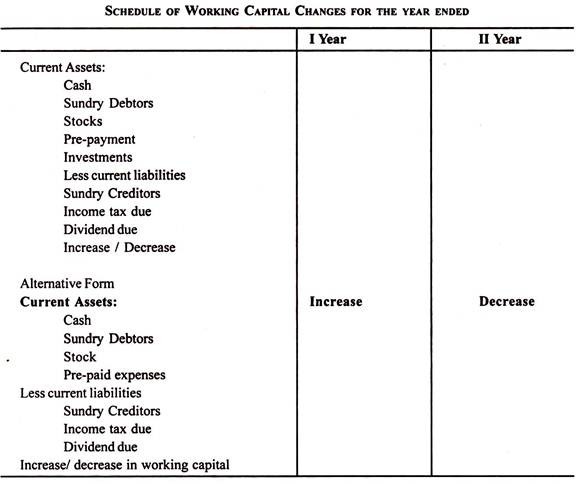

(A) Schedule of working capital changes.

ADVERTISEMENTS:

(B) Statement of sources and uses of fund.

(A) Schedule of Working Capital Changes:

This schedule is also called ‘Comparative Change in Working Capital Statement’ of ‘Statement of Working Capital Changes’ or ‘Working Capital Variation Statement’ or ‘Net Current Assets Account’ or ‘Working Capital Account’.

The increase in working capital is treated as use of fund and decrease in working capital is termed as sources of fund. This statement or schedule is prepared in such a way or form as to indicate the amount of working capital at the end of two years as well as increase or decrease in the individual items of current assets and current liabilities.

ADVERTISEMENTS:

The following rules should be taken into account while ascertaining the increase or decrease in individual items of current assets and current liabilities and its impact on working capital:

i. Increase in the items of Current Assets will increase the Working Capital.

ii. Decrease in the items of Current Assets will decrease the Working Capital.

iii. Increase in the items of Current Liabilities will decrease the Working Capital.

ADVERTISEMENTS:

iv. Decrease in the items of Current Liabilities will increase the Working Capital.

(B) Statement of Sources and Uses of Fund:

This is the second but most important part of Fund Flow Statement. It is prepared on the basis of the changes in Fixed Assets. The preparation of Statement of Sources and Uses of Fund involves the ascertainment of increase/decrease in the various items of fixed assets, long term liabilities and share capital in the light of additional information given below. To give an idea of the different items of sources and uses, the probable items of sources and uses of fund are tabulated below.

Sources of Fund:

1. Issue of fresh shares (derived from increase in share capital).

2. Issue of Debentures (derived from increase in debentures).

3. Raising of new loans (derived from increase in long term loans).

4. Sale of fixed assets for cash or for other current assets (derived from decrease in fixed assets and additional information).

ADVERTISEMENTS:

5. Non-trading income.

6. Profit from operations (before deducting non-cash items of expenses and losses and before adding non-cash, non-trading income).

7. Decrease in working capital (derived from the schedule of working capital changes).

Uses of Fund:

ADVERTISEMENTS:

1. Redemption of Preference Shares in cash (derived from decrease in share capital).

2. Redemption of debentures in cash (derived from decrease in debentures).

3. Repayment of loans (derived from decrease in long-term loans).

4. Purchase of fixed assets for consideration other than shares, debentures or long term debt (derived from increase in fixed assets and additional information).

ADVERTISEMENTS:

5. Loss from operations.

6. Payment of dividend in cash.

7. Increase in working capital (derived from the schedule of working capital changes).